For the past year and a half, biotech stocks have been on the move.

Companies have barely been ordering new supplies.

Why? Because during COVID, biotech companies went on a massive spending spree and stockpiled everything.

Then when things calmed down, they just... stopped buying.

Over the last 24 months, they have been surviving off of this over supply.

But that supply is now starting to run out…

Wall Street calls this "destocking" - basically running down your pantry instead of going to the grocery store.

Here’s the thing: Eventually, that supply is going to run out completely, because things like stoppers, vials, and syringes are vital to the industry.

And when biotech companies start ordering again, it's going to be a flood.

That potential surge in demand could be on the horizon - which means biotech companies that make these essential goods could see demand grow rapidly.

That’s creating a potential investment opportunity for investors to profit as demand grows.

Let’s break down what the destocking cycle looks like, the opportunities it’s creating in biotech stocks, and the risks you need to know about.

But first: You can get a more in-depth breakdown of each opportunity our market analysts spotted in biotech by subscribing to Market Briefs Pro.

The report gives you more data and research into these opportunities, which helps you get an edge on the rest of Wall Street by being a smarter investor.

If you want the full report, subscribe to Market Briefs Pro.

Understanding the Destocking Cycle

During the pandemic, biotech companies were hoarding supplies, as they had no idea what demand was going to look like a day or even 10 months in advance.

Everything from basic medical supplies to specialized equipment was getting stockpiled.

At the peak, companies had about 8 months' worth of inventory sitting in warehouses.

That’s way more than what’s normal (3-4 months).

West Pharmaceutical's CFO said in October 2025 that destocking was "finally behind us."

Pharmaceutical company Merck confirmed it in July of 2025 and S&P analysts said the same in April.

Translation: The pantry is empty, and companies are starting to restock.

The Setup: Empty Warehouses Meet Exploding Demand

Fast forward to today. Inventory is sitting at historic lows. Companies have been burning through their stockpiles, and they're finally hitting the point where they need to reorder.

But here's the twist: Normal isn't what it used to be.

Weight Loss Drugs Changed Everything

While companies were living off old supplies, something massive happened in the market.

Think Ozempic, Wegovy, and Zepbound - demand for these weight-loss drugs has exploded in recent years.

In November 2021, about 5 million patients globally were on GLP-1 drugs.

By November 2024? Nearly 20 million patients.

That's 4x growth in just three years.

We're talking about drugs so popular they've been classified as "limited supply" since early 2024 because manufacturers literally can't make them fast enough.

- Every single dose needs stoppers, plungers, syringes, and vials.

Novo Nordisk and Eli Lilly control 96% of the global GLP-1 market and both companies are racing to build capacity.

Eli Lilly just announced a $6 billion facility in December 2025 to produce more weight loss drugs - that’s a big investment that shows their commitment to the industry.

And it's not just about the drugs that exist today.

There are over 80 experimental obesity drugs in human testing right now.

If even a fraction of those succeed, we're looking at exponential growth in demand for basic biotech supplies.

Here’s where the global injectable volume market could be headed next:

- 2024: 45 million units.

- 2025: 65 million units (forecast).

- 2026: 95 million units (forecast).

- 2027: 130 million units (forecast).

That's nearly 3x growth in just three years.

The Alzheimer's Breakthrough

In August 2025, the FDA approved Leqembi - the first at-home Alzheimer's treatment via weekly injection.

This is huge because millions of patients could soon need weekly shots instead of hospital visits.

Venture Capital Returns

During the destocking period, venture capital funding for biotech startups dried up.

Higher rates, geopolitical issues, and inflation pushed the market into a downturn in 2022, after a boom in 2021.

But in Q3 2025, biotech venture capital funding jumped 70% compared to earlier quarters.

Why does this matter? Because when biotech startups get funding, roughly 50% of that capital goes directly to purchasing lab equipment, manufacturing supplies, and research materials.

More venture capital = more orders for companies like Thermo Fisher and West Pharmaceutical.

And those orders aren't one-time purchases.

Once a startup sets up its lab with Thermo Fisher equipment, they're locked into that ecosystem.

That means regular orders of consumables, reagents, and replacement parts for years.

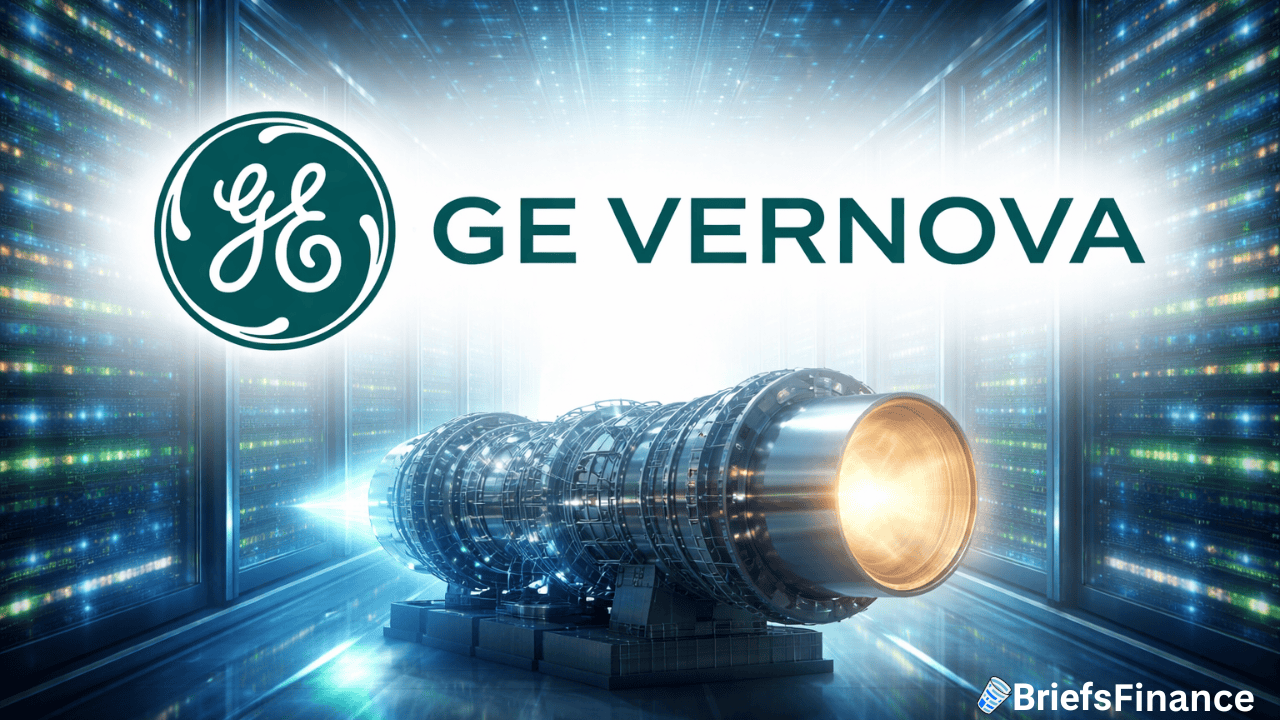

Congress Just Forced Companies to Buy American

But there’s even more to this market shift that investors need to look at.

In December 2025, Congress passed the Biosecure Act.

This law went into effect on December 7th, 2025, and it fundamentally changes where American biotech companies can buy supplies.

The law specifically bans American companies from using certain Chinese biotech suppliers.

For biotech companies that were relying on cheaper Chinese materials, they now have no choice but to switch to U.S.-based suppliers.

And the transition is already happening - pharmaceutical companies are scrambling to find Western suppliers who can match the capacity they were getting from China.

That means more orders flowing to American manufacturers - whether biotech companies like the higher prices or not.

The Opportunity: Selling Picks and Shovels

Here's the beautiful part about this opportunity: You don't need to guess which drug will be the next blockbuster.

During the California Gold Rush, most miners went broke chasing gold.

But the people selling pickaxes and shovels? They made fortunes no matter who struck gold or who came up empty.

The same principle applies here.

We don't need to know which pharmaceutical company will create the next miracle drug.

We just need to find the companies supplying the tools and materials to make all the drugs.

So which companies specifically may benefit from this biotech investing opportunity?

West Pharmaceutical: The Position Leader

When a pharmaceutical company submits a new drug for approval, they have to list every single component of how that drug will be delivered.

This includes the exact specifications for stoppers, plungers, and syringes - and who makes them.

Once the FDA approves a drug with a specific supplier's components, switching suppliers requires refiling the entire drug. That process takes years and costs millions.

This creates what investors call "regulatory lock-in."

Here's why this matters:

Let's say Novo Nordisk wants to launch Wegovy (their weight loss drug). They design the pen injector with West Pharmaceutical's (WST) NovaPure stoppers and FluroTec-coated plungers.

They file with the FDA: "Our drug will be delivered using West Pharmaceutical components with these exact specifications."

The FDA approves it.

Now Novo Nordisk is locked in. They can't just call up a competitor and say, "Hey, we found cheaper stoppers."

Switching would mean:

- Redesigning the entire delivery system

- Running new stability studies (6-12 months)

- Refiling with the FDA (12-24 months)

- Millions in additional costs

So they don't switch. They stay with West Pharmaceutical, even if West raises prices by 5% or 10%.

This is why West Pharmaceutical has such a powerful position: Their packaging components are written into the FDA filings for major GLP-1 products.

They're not just a supplier - they're locked into the drug itself.

Drug companies can't just switch to a competitor because West Pharmaceutical raised prices or because they found a cheaper option.

They're stuck with West Pharmaceutical unless they want to go through years of regulatory hurdles.

And West Pharmaceutical supplies many of the biggest weight loss drugs on the market right now.

Shares of West Pharmaceutical are down nearly 18% year-to-date as of December 2025. That sounds bad, but we believe it's undervalued right now.

The stock fell in February 2025, but it's recovered 19% in the past six months as investors started to realize destocking was ending.

West Pharmaceutical's average analyst price target is $347 - but the stock is currently trading around $269. Most analysts still rate it a "buy."

That represents about 29% upside if the stock reaches analyst targets.

Here’s the thing: There are other stocks that may benefit from this impending biotech boom - our market analysts identified other opportunities in Market Briefs Pro.

If you want to discover what the other potential investing opportunities are if you want more, you’ll need to subscribe to Market Briefs Pro.

Learn more and subscribe here.

Biotech Stock Risks You Need to Know

Here are the risks investors should know before investing into biotech in 2026:

Valuation Risk

Many companies in biotechare currently trading well above their earnings, even above their historical averages.

If 2026 profits don't meet expectations, these stocks won't just underperform - they could lose value.

Investors are pricing in a strong recovery. If orders come back slower than expected, or if margin expansion doesn't materialize, the stocks could fall.

Transition Risk

The Biosecure Act should drive demand to American suppliers, but the transition away from Chinese companies could take longer than expected.

If pharmaceutical companies struggle with the swap or face unexpected costs, it could temporarily reduce their orders to American suppliers.

Some companies might delay new projects rather than deal with supply chain disruptions. That would push the recovery timeline further out.

Long-Term Industry Cycles

And let's remember the big picture: Biotech is a long-term industry.

Market recoveries, new investments, and breakthrough technologies can all take significantly longer than projected.

Just because destocking is over doesn't guarantee demand will immediately explode - it could be a gradual build throughout 2026 and beyond.

Investors will need patience if they believe in this market shift and opportunity.

Biotech Stocks: Frequently Asked Questions

What are biotech stocks?

Biotech stocks are shares of companies involved in biotechnology and the use of biological processes for medical, agricultural, or industrial purposes.

This includes pharmaceutical companies developing new drugs, as well as suppliers providing the tools and materials these companies need.

Why are biotech stocks expected to perform well in 2025?

After 18 months of "destocking" (using up old supplies instead of ordering new ones), biotech companies are running out of inventory.

Combined with surging demand for weight loss drugs, new Alzheimer's treatments, and legislation forcing American manufacturing, orders for biotech supplies are expected to surge in 2026.

What are the best biotech stocks to watch in 2025?

Best is relative based on your own goals, risk tolerance, and time horizon.

Some companies positioned to potentially benefit from increased biotech supply orders include West Pharmaceutical Services (WST) and Thermo Fisher Scientific (TMO).

These companies supply essential tools and materials to the entire biotech industry, regardless of which specific drugs succeed.

How does the Biosecure Act affect biotech stocks?

The Biosecure Act, which went into effect in December 2025, forces American biotech companies to stop using Chinese suppliers and buy from American manufacturers instead.

This is expected to significantly increase orders for U.S.-based biotech supply companies.

Are biotech stocks risky?

All stocks carry risk.You are never guaranteed to make money when you invest. In fact, you will probably lose money at some point.

Biotech supply stocks trade at premium valuations, meaning if profits don't meet expectations, share prices could fall.

The transition from Chinese to American suppliers could also take longer than expected. But, high risk can sometimes come with high reward, so investors will want to keep individual opportunities in mind when it comes to Biotech.

What are GLP-1 drugs and why do they matter?

GLP-1 drugs like Ozempic, Wegovy, and Zepbound are weight loss and diabetes medications that have experienced explosive demand growth.

Global patients on GLP-1 drugs grew from 5 million in November 2021 to nearly 20 million by November 2024 - 4x growth in three years.

Each dose requires stoppers, plungers, syringes, and vials—creating massive demand for biotech supplies.

When will biotech supply orders recover?

According to company executives and industry analysts, destocking ended in late 2025.

Orders are already starting to return, with Q1 2026 expected to show the first significant surge.

However, it could be a gradual build throughout 2026 rather than an immediate spike.

The Bottom Line For Biotech Stocks

For 18 months, biotech companies have been living off supplies they stockpiled during COVID.

Those warehouses are nearly empty now, and orders are coming back.

But they're not coming back to the old normal because the market has changed:

- Weight loss drugs need millions of weekly injections.

- Alzheimer's treatments are moving into homes.

- Venture capital is flowing again.

- Chinese suppliers are banned.

Investors who understand this shift may want to keep biotech supply companies in mind as we head into 2026.

Remember: This isn't about finding the next miracle drug. It's about finding the companies that make it possible to manufacture every drug.

That’s the pick & shovels approach our analysts are using for this market shift - but we’ve identified other opportunities in different industries.

Which ones? Found out by subscribing to Market Briefs Pro.

The weekly report breaks down the top market shifts happening today and specific investment opportunities investors may be able to profit from right now.

If you want more of our reports, subscribe here.